Japanese Withholding Tax (1)

Withholding tax is common tax practice you can see around the world.

But some people say that there is no more successful nation than Japan in terms of implementation of withholding system.

Table of Contents

“Taxpayer” and “Withholding agent”

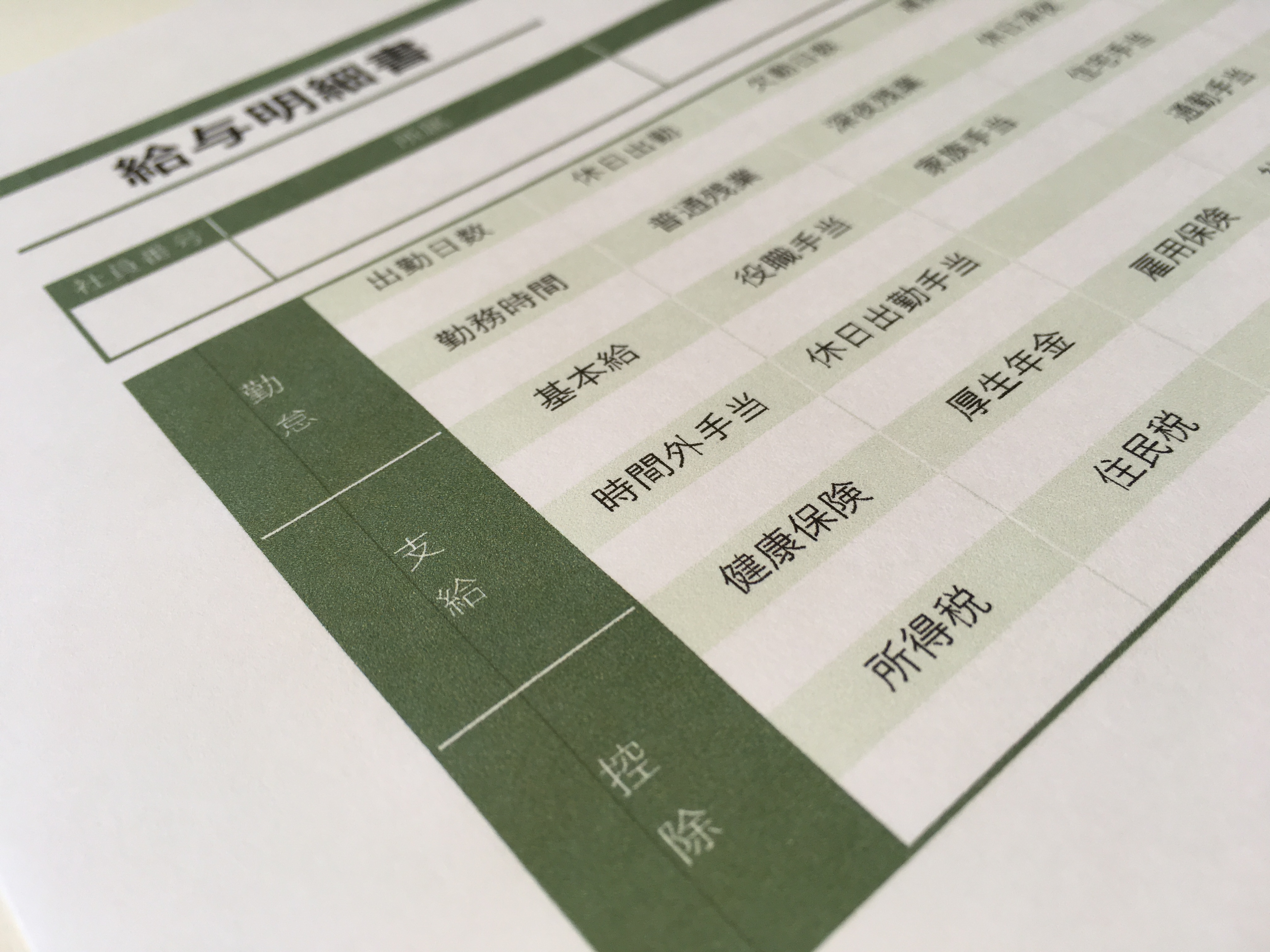

As you know, income tax, inhabitant tax, social insurance tax are withheld from your salary and bonus payments.

Consideration for some professional services rendered by a freelancer is subject to withholding taxes.

Dividend, coupon and interest payments are also subject to withholding taxes at source.

These withholding taxes are born by payee of salary, professional fee, dividend, coupon and interest i.e, “taxpayer”.

However, the withheld taxes are paid to the governments or the authorities by payer of the above income.

Such income payers (including legal entities such as corporation) who owes tax liability of withholding and payment are called as “withholding agent”.

Penalty on withholding agents

Who should be subject to penalty if either i) no tax was withheld, ii) withheld tax amount was wrong, or iii) withheld taxes are not timely paid to the government?

As for income tax, delinquency of tax payment is subject to the 5% or 10% penalty and the 2.6% or 8.9%* interest charge.

These high rate charges can be heavy burden under ultra low interest policies.

* applicable to delinquency in 2018. The interest charge rate is periodically updated linked to official discount rate announced by the bank of Japan.

###

to be continued.