Japanese Withholding Tax (2)

Continued from previous blog.

Table of Contents

So ambiguous and complicated

In the case iii) , it makes sense that withholding agent is penalized for its delinquency as it is quite obvious that the withholding agent did not fulfill its own duty by negligence.

However, the case i) and ii) are not necessarily attributable to negligence of withholding agent.

As for the case i), there may be some cases it is quite difficult for withholding agent to anticipate that income he or she pays is subject to withholding taxes.

For instance, in the case where the tax laws do not provide clear-cut rules on withholding and withholding agents cannot know their obligation for sure, I think, it hardly makes sense that the government accuse such “innocent” withholding agent of negligence.

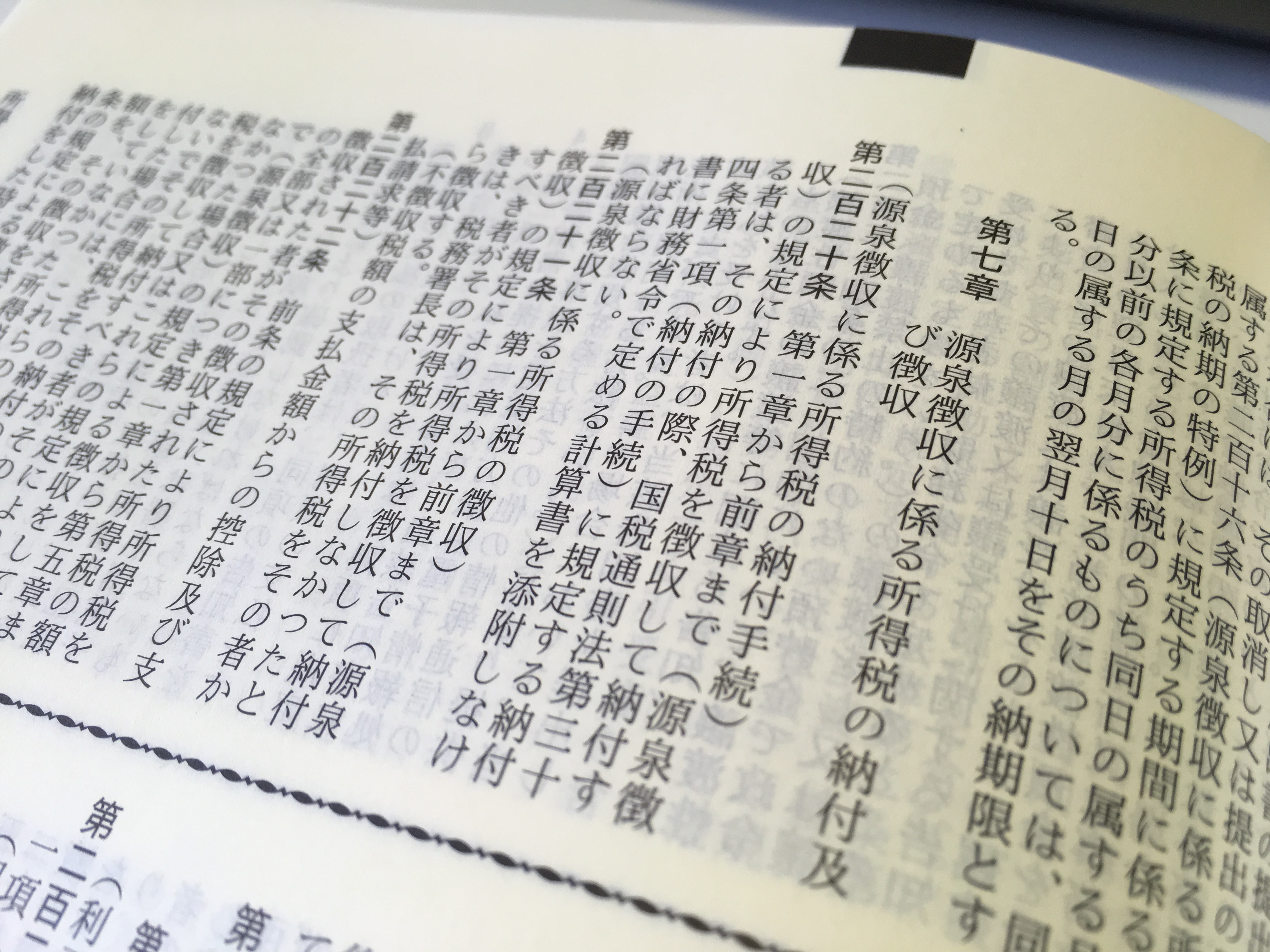

Japanese income tax code provides withholding obligation by each type of income.

In other word, you are obliged to withhold tax from only income payment specifically provided in the code.

The tax code shall clearly define scope of the obligation imposed on citizen.

Otherwise the governments may easily construe the code in their favor and infringe right of people.

Ordinary people do not have to read “between the lines” of the tax codes to judge their tax liabilities.

As for the case ii), there may be the cases that withholding agent realized his/her obligation but had applied different provisions of the tax code or miscalculated withholding tax amount.

Just simple miscalculation cannot exempt from penalty. But misapplication is sometime made due to ambiguous or outdated tax code and regulations.

As a matter of fact, the Japanese income tax code does not catch up with development of new businesses such as “emerging right” derived from IT and intellectual property, financial product and so on.

I would say it is not fair to make business person judge their withholding obligation applying outdated tax code to new business.

Having said so…

Under the Japanese income tax code, it is only withholding agent who is subject to the penalty and interest charge regardless of reason for delinquency of tax payment although it is not withholding agent’s tax but taxpayer’s.

So even if the taxpayer knew tax implication much better than the withholding agent but failed to tell it to the withholding agent, only the withholding agent is penalized.

Does this really make sense?

So quite a few “innocent” withholding agent attempt fending off tax assessment appealing “Just I didn’t know it!”, “they did not tell it to me!!”, “the code does not clearly say to withhold!!!” then “this is totally unfair!!!!”.

I said the same things many times to tax auditors.

it is all for today.

To be continued.