Simple questions about Japanese final income tax returns

The acceptance of the 2018 final income tax final return will be full-fledged from today.

The tax office also becomes busier.

I think numbers of people would get started preparation of the income tax return this week and try contacting the tax office for guidance.

But some may be at a loss because they cannot reach.

Around time of every year, some of my relatives and friends try catch me saying “just a couple of questions”.

So, today I would like to talk about “simple questions about final income tax return” taking this opportunity.

Table of Contents

Should file the tax return even if the Year-End Adjustment has been made?

When income is salary only

If the income is only for salary throughout the year, as long as the annual income does not exceed 20 million yen, the income tax payment should have been completed by the year-end adjustment, so the final return is “unnecessary” in principle.

“Unnecessary” means “no need to do” and it does not mean that you should not file any final tax return.

Therefore, if it is more advantageous to declare a final return, you can file a final return.

For example, if there is any deduction (such as medical expenses deduction, mortgage deduction etc.) that was not handled by the Year-End Adjustment, it is more advantageous to file the final tax return.

You would be able to claim more deductions by filing the tax return, and as a result, “income tax after year-end adjustment” exceeding “annual tax due declared by the tax return” will be tax refund.

But, for those who have zero annual tax amount after the Year-End Adjustment, there is no tax amount to be refunded even if the more deductions are claimed, so there is no merit to file the final tax return.

However, even if you can not expect the tax refund, you should show your intention to the tax office by filing the tax return that you have been applying special tax credit of housing mortgage from the initial year that you purchased the house with the mortgage .

When there is income other than salary

When there is income other than salary

If you have income in addition to salary that had been subject to the Year-End Adjustment, and amount of such net income amount (income amount – necessary expenses) exceeds 200,000 yen, you would have to file the final tax return.

However, there are many exceptions to this.

For details, please refer to the blog “side job and final tax return filing” or contact me.

Should file the tax return if no Year-End Adjustment?

n principle, you should file the final tax return.

However, there are exceptions.

If the sum total of all income including salary income does not exceed the total amount of various income deductions, that is, when the income amount to be taxed becomes zero or a deficit, declaration is unnecessary.

This is in line with the general perception that “unnecessary to declare a tax if total salary amount for the year was less than 1,030,000 yen”.

For salary income, “salary income deduction” is allowed as an approximate amount of necessary expenses of which, the minimum amount is 650,000 yen.

Besides, a 380,000 yen “basic deduction” is granted to everyone.

The 1,030,000 yen means sum of those deductions.

As long as the total payment of salary does not exceed 1,030,000 yen, there should be no income to be taxed.

Besides, even when there is taxable income amount, tax filing is not necessary as long as income tax amount calculated by multiplying it by tax rate does not exceed “amount of dividend deduction”.

Even in such a case, if there is any income that had been subject to withholding income tax, you can get refund of that withholding tax by filing the final tax return.

If there is a withholding tax amount even if the total salary does not exceed 1,030,000 yen, it is better to file the tax return to claim the refund.

Difference between the final tax returns in “Blue” and “White”

If you have business income, real estate income, or forest income, you have to file a breakdown details of those incomes together with the final tax return form.

There are two types of the breakdown, “financial statements for blue tax return” and “breakdown of revenue and expense” (there are “for real estate income” and “for general use”, respectively).

A tax return prepared based on the financial statements is named as “blue tax return” and the one, prepared based on the breakdown of revenue and expense, is called “white tax return”.

There is no definition of “white tax return” in the law, and it should be officially called “tax return other than blue tax return”, but “white tax return” has been widely accepted as a general term. I have no idea Why it is not “red” or “yellow”.

For blue tax return, in calculation of business income and real estate income, special deduction of 650,000 yen (100,000 yen, if the financial statements are prepared on cash settlement basis) is granted.

But filing of blue tax return can not be done arbitrarily.

Filing of the blue tax return is approved only when you are authorized by the director of the tax office on the premise that you can keep a systematic book based on “double entry bookkeeping” and prepare the financial statements based on that book.

In order to obtain the approval of the blue tax return, the application form “application for filing of the blue tax return” have to be filed to the director of the tax office by March 15th of the year when you are going to file the first blue tax return. (When the business or real estate leasing commence after January 16th of that year, that application form have to be filed within 2 months after the commencement of such businesses (for non-resident, 2 months after commencement of the business conducted in Japan).

Even if you can get approval, it may be revoked when bookkeeping is not well performed.

If you have not applied for a blue tax return (or not approved), or the approval is revoked, you should file the “white tax return”.

Deduction of expenses allowed even with no sales?

It is a common that costs are incurred prior to sales, so I think that you can claim expense deduction even if the sales are zero.

However, it is necessary to satisfy both of the following two requirements.

- Substance that “the business is being conducted on a continuous basis”

Just naming your hobby as a “business” is not acceptable (as not for profit).

“Business” solely to minimize other taxable income by maximize expense is neither acceptable (as no economic substance exists).

Not only the fact of submission of the “Notification form of business commencement” but the fact that the business have been conducted for commercial purposes is needed.

For instance, an actor/actress attending actor’s school and applying to auditions while working part-time would be able to claim deduction of expenses such as tuition of that school, travel expense to audition site, costume, make-up.

Meanwhile, if a salaried worker decides to publish a restaurant guide book as a side job but has neither started drafting the book nor negotiation with publisher yet, reducing taxable income by claiming deduction of dining expense would be at high risk. - That expenses are “necessary for business”

Although it is not limited to the year of zero sales, expenditure which is not necessary for business can not be necessary expenses.

For example, in the case of a business that does not require a car at all, if you claim deduction of gasoline charge, maintenance expenses, depreciation expenses as necessary expenses, there is a high possibility of being denied by tax audit.

Also, it would be hard to justify deduction of entertainment expense if it is excessive compared with expected sales (not balanced). Neither it is when expenses of rents or food/drinks are not segregated by personal or business uses.

Conversely, even if you are not profitable, certain expense that is “essential” to keep on doing your business, it should be qualified as a necessary expenses as long as it is reasonable amount (to extent of the common sense).

For instance, advertising cost for a newly opened store, expenses for licenses or registration required for new business, costs of office equipment, commutation expense to the workplace, etc may not directly contribute to sales but they can be regarded as expenses necessary for business.

Having said so, luxurious (not balanced) spending would attract challenge in tax audit because of non-necessity in terms of quantity even if it can be necessary in terms of quality.

Banquet with friends rather than business partners, too luxury furniture and fixtures, commutation by taxi/own car to the office that is close to station, such expenses would be at high risk.

By the way, stock of goods (such as goods for sale, products, work in process, raw materials) at the end of the year always have to be excluded from the necessary expense.

Difference in formats of tax return (type A / type B)

There are A and B in the type of the income tax return forms.

Type A is a simplified form designed for those who declare only salary income, public pension, miscellaneous income, dividend income, temporal income, with no interim tax payment requirement.

Type B is a full-spec version can be used by anyone for any income.

If you have business income, real estate income, capital gain or incurred net loss (negative amount of income) carried forward, you are supposed to use type B.

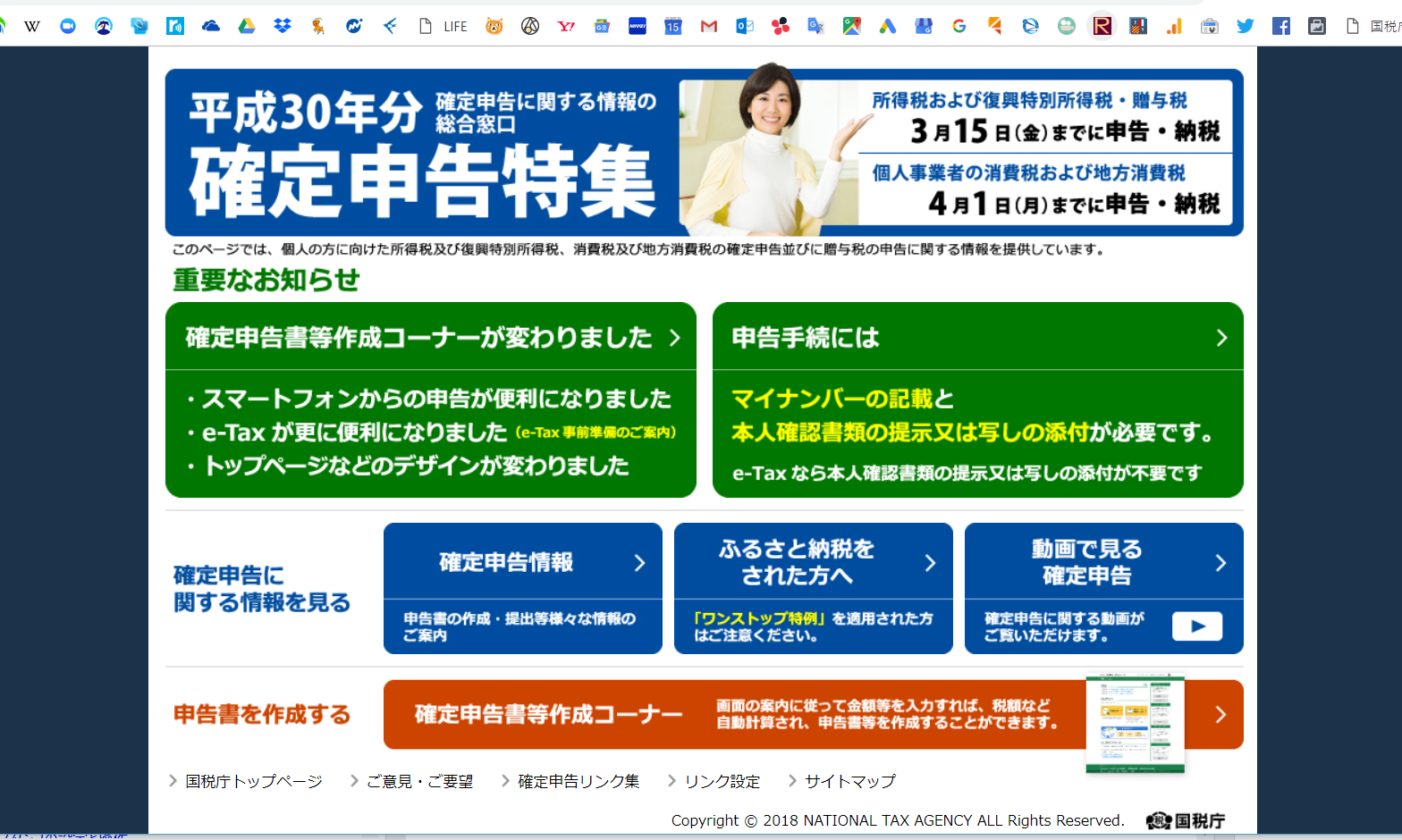

Each form can be downloaded from home page of the National Tax Agency.

They are available at the tax office, but it seems that they have little inventory of the type A recently.

So tax officer may give you type B even if you wanted type A.

The portal site for tax return preparation does not work well?

It may not work if it does not conform to the recommendation environment of the National Tax Agency’s website.

There is no problem for Windows 10 + Internet Explorer 11.

Is the e-Tax readily available?

Advance procedures are necessary.

First of all, you need to obtain an electronic certificate (e.g., a My Number Card).

Next, you need a device “IC card reader” so that the PC reads the electronic certificate.

Finally, you have to file an application for usage of e-Tax to the tax office so that you obtain ‘user identification number’.

It takes about 3 weeks from application to receipt to obtain the My Number Card.

You may submit the application to the tax office electronically (online submission) via the Internet.

In that case, the “user identification number” from the tax office will also be notified online, so if you already have a My Number card, I suppose, it would not take much time to prepare in advance.

IC card readers are available at major home appliance stores and Amazon.

I am using this one.

***

I am going to post another blog on income tax return filing in the sequel if further ‘simple questions” addressed to me.

Your inquiries are always welcome.