2021-08-15

Inventory Valuation

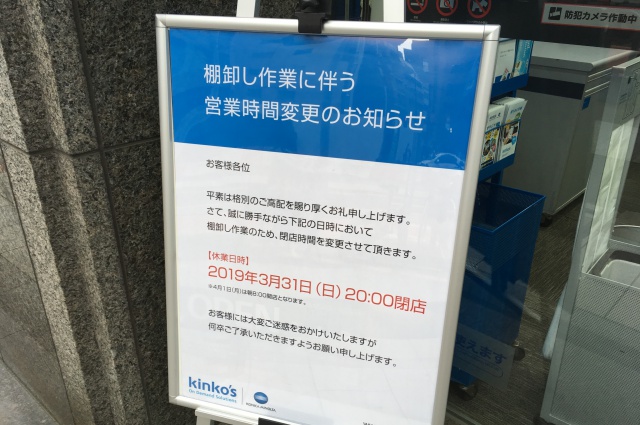

The above picture is a signboard I saw near my office the day before yesterday. Probably their fiscal year ending date is March 31. The signboard tells that they will close the shop earlier on this coming Sunday as they are going to do stock-taking on that evening. What a diligence! So today’s topic is an inventory valuation.

Table of Contents

Why need to evaluate your inventories?

What is a stocktaking?

Have you ever experienced a stocktaking?

Person doing whole seller or retail business may know it well but who are not dealing with physical commodities may have no idea what it is.

A Stocktaking is the process of tallying up inventories such as commodities, products and materials.

When you count the inventories, you would have to unload stock from a shelf, so someone had named it as “stocktaking”.

Burden of the stocktaking would be tremendous when you have great number/variety of inventories. Besides, it should be performed by respective offices, factories, warehouses.

Companies doing diligent inventory control performs more frequent stocktaking as well as fiscal year end.

As known for the Kanban Method (just-in-system) by Toyota Motors, stringent inventory control could contribute to business management by reducing redundant inventories.

As known for the Kanban Method (just-in-system) by Toyota Motors, stringent inventory control could contribute to business management by reducing redundant inventories.

To work out cost of sales

Any corporation or sole proprietor whatsoever need to work out cost of sales to calculate profit of business.

The cost of sales means acquisition cost of goods you sold.

If you sold all of goods you had purchased, total purchase price of the goods becomes cost of sales.

However, it is usual that you have some leftovers at the fiscal year end. In that case, the cost of sales will be calculated as follows:

The Cost of Sales = Total Purchase Price – Ending Balance of Inventories

However, it is usual that you have some leftovers at the fiscal year end. In that case, the cost of sales will be calculated as follows:

The Cost of Sales = Total Purchase Price – Ending Balance of Inventories

More realistically, some inventories are brought-forward from prior fiscal year. In such case, the cost will be calculated as follows:

The Cost of Sales = Beginning Balance of Inventories + Total Purchase Price – Ending Balance of Inventories

The Cost of Sales = Beginning Balance of Inventories + Total Purchase Price – Ending Balance of Inventories

As shown above, you need to know value of inventories to figure out the cost of sales.

Since the cost of sales is a figure used for income tax calculation as well as financial reporting, it is obvious that accuracy of such reporting depends on accuracy of stocktaking.

To recognize loss or impairment

You may know outstanding balance of inventories by books and records. However, actual (physical) balance may not match with the records.

For instance, the inventory book indicates balance of a 100 at the fiscal year end but actual balance confirmed at the warehouse was 96.

In that case, you should examine what caused discrepancy of 4.

They might had been shipped to another place as display/sample, or stolen/damaged.

Then you need to take necessary action against prevention of recurrence. Especially for physical loss or damage, you would have to come up with appropriate measure depending on whether it was force majeure (disaster) , wrongdoing (theft, destruction) or inevitable loss due to nature of goods (evaporation, leakage).

They might had been shipped to another place as display/sample, or stolen/damaged.

Then you need to take necessary action against prevention of recurrence. Especially for physical loss or damage, you would have to come up with appropriate measure depending on whether it was force majeure (disaster) , wrongdoing (theft, destruction) or inevitable loss due to nature of goods (evaporation, leakage).

Besides, stocktaking will help you to examine not only quantity but quality of inventories.

Obsoleted or deteriorated inventories would be no longer available for sale at regular price.

You should decide whether they are discarded or discounted taking the condition of the inventories into consideration.

Obsoleted or deteriorated inventories would be no longer available for sale at regular price.

You should decide whether they are discarded or discounted taking the condition of the inventories into consideration.

Valuation methods

So what can be the basis for monetary valuation of the ending balance of inventory?

We have two methodologies; Cost Method or Lower-of-Cost-or-Market method.

Cost Method

It is the valuation method based on historical cost (actual acquisition cost).

Lower-of-Cost-or-Market (LCM) method

It is to evaluate based on either lower of the historical cost or market price as of the fiscal year ending date.

Under this method, price depreciation of inventories will be included in the cost of sales.

Accordingly, it will work out more cost of sales (i.e., lesser profit) compared with Cost Method when the price is under downtrend.

This method may provide a tax advantage (lessen taxable income) but not applicable if you cannot have reasonable evidence of the market price.

This method should be applied only when prevailing market price is disclosed or available.

Under this method, price depreciation of inventories will be included in the cost of sales.

Accordingly, it will work out more cost of sales (i.e., lesser profit) compared with Cost Method when the price is under downtrend.

This method may provide a tax advantage (lessen taxable income) but not applicable if you cannot have reasonable evidence of the market price.

This method should be applied only when prevailing market price is disclosed or available.

How to work out the Historical Cost

The Historical Cost is the common basis for Cost Method and LCM method.

In fact, calculation of Historical Cost sometimes can be burdensome.

It is quite normal that Historical Cost differs by each purchase when you purchase great number of goods continuously for certain period of time.

Under such situation, you need to establish certain assumption in what order the goods (of what Historical Cost) had been sold during the period.

The following 6 assumptions of cost-flow are currently adopted under Japanese accounting and tax rules.

In fact, calculation of Historical Cost sometimes can be burdensome.

It is quite normal that Historical Cost differs by each purchase when you purchase great number of goods continuously for certain period of time.

Under such situation, you need to establish certain assumption in what order the goods (of what Historical Cost) had been sold during the period.

The following 6 assumptions of cost-flow are currently adopted under Japanese accounting and tax rules.

Specific identification method

You track the specific cost of individual items of inventory.

This method usually applies to high-value inventory (real estate, precious metals, jewelries etc.) which can be identified by registration or its appearance.

This method usually applies to high-value inventory (real estate, precious metals, jewelries etc.) which can be identified by registration or its appearance.

First-In-First-Out (FIFO) method

You assume that the first items to enter the inventory are the first ones to be used or sold.

As the result, ending balance of inventory will be valued at relatively recent Historical Cost.

As the result, ending balance of inventory will be valued at relatively recent Historical Cost.

Average method

Assumes that the Historical Cost is simple average value calculated as follows:

Average value = (Value of beginning balance of inventory + total purchase cost for the period) ÷ total units of those items

This is simple method but has a downside that the average value could deviate from the recent market value due to irregular purchase (e.g., massive purchase made on specific at abnormal price).

Moving average method

Under this method, the average value will be updated at weighted average cost every time new purchase is made.

It would be more reasonable than the simple average method but requires more burden of calculation.

It would be more reasonable than the simple average method but requires more burden of calculation.

The last purchase price method

Assumes that the Historical Cost is actual price of the latest purchase.

It is reasonable methodology from Balance Sheet perspective as the ending balance of inventory is evaluated at the most recent price.

However, it may not be reasonable from profit and loss perspective as the Cost of Sales can be distorted by deviation of the last purchase price from average purchase prices.

It is reasonable methodology from Balance Sheet perspective as the ending balance of inventory is evaluated at the most recent price.

However, it may not be reasonable from profit and loss perspective as the Cost of Sales can be distorted by deviation of the last purchase price from average purchase prices.

Retail method

Evaluate ending balance of inventories based on sales price as of the fiscal year ending date.

As this method relies on certain assumptions to give realistic results, you need to maintain a consistent markup percentage by inventory group to calculate a reliable cost/retail ratio.

This method is usually used by retailers such as supermarkets, convenience stores and department stores who have difficulties for tracking the Historical Cost of diversified merchandise but have good EDP system to monitor retail price (e.g., the POS).

This method is usually used by retailers such as supermarkets, convenience stores and department stores who have difficulties for tracking the Historical Cost of diversified merchandise but have good EDP system to monitor retail price (e.g., the POS).

Stocktaking is an essential process!

As aforesaid, it is usual that you face discrepancy of inventory between the records and actual outstanding balance.

Also, you will never be able to know quality of the inventories unless you take a look at them.

Besides, frequent stocktaking works as a containment to black-market channels or embezzlement.

Regular stocktaking is strongly recommended for internal control and sales management as well as financial reporting, tax filing.

Also, you will never be able to know quality of the inventories unless you take a look at them.

Besides, frequent stocktaking works as a containment to black-market channels or embezzlement.

Regular stocktaking is strongly recommended for internal control and sales management as well as financial reporting, tax filing.

***

The parents in-law of my younger sister used to raise beef cattle naming one by one.

Cattle for sale are also an inventory.

Now I become to suspect that the naming might have been for inventory control (Specific Identification Method) rather than attachment to them.

Cattle for sale are also an inventory.

Now I become to suspect that the naming might have been for inventory control (Specific Identification Method) rather than attachment to them.