Cloud Service and Reverse Charge (2)

Continued from previous blog.

There are two ways to impose the Consumption Tax on services rendered outside Japan.

Table of Contents

For B2C(Business to Consumer)

The first method is having offshore providers file tax returns and pay tax to the Japanese government.

This method is applied to services for general consumers i.e., Business to Consumer so called “B to C” or “B2C” businesses.

Under this method, offshore B2C service provider will collect Japanese Consumption Tax from Japanese consumers together with service fees then file Consumption Tax Return and pay tax to the Japanese government as same as onshore providers do.

This is to put offshore providers into onshore providers’ shoe.

The offshore B2C providers who are subject to the Japanese Consumption Tax under this method should be registered to the National Tax Agency as “Registered Foreign Business”. The NTA disclose and update list of the RFBs from time to time.

So if your provider is not listed as the RFB but charged you Consumption Tax, you should asked him/her like this “Hey, you are not Japanese taxpayer are you? Why you are entitled to charging this Japanese Consumption Tax to me?”.

For B2B(Business to Business)

The second method is the “Reverse Charge” system.

This is applied to services provided by offshore provider for domestic enterprise consumers i.e., Business to Business so called “B to B” or “B2B” businesses.

This method is having the domestic enterprise consumers file tax returns and pay tax on behalf of offshore service providers.

It works as if a domestic consumer collect Output Tax from itself then report it as its Output Tax in its tax return.

At the same time, the paid tax (hypothetically and internally paid tax) is deemed as Input Tax for its on tax return purpose and can be credit against Output Tax subjecting to limitation based on “Taxable Sales Ratio”.

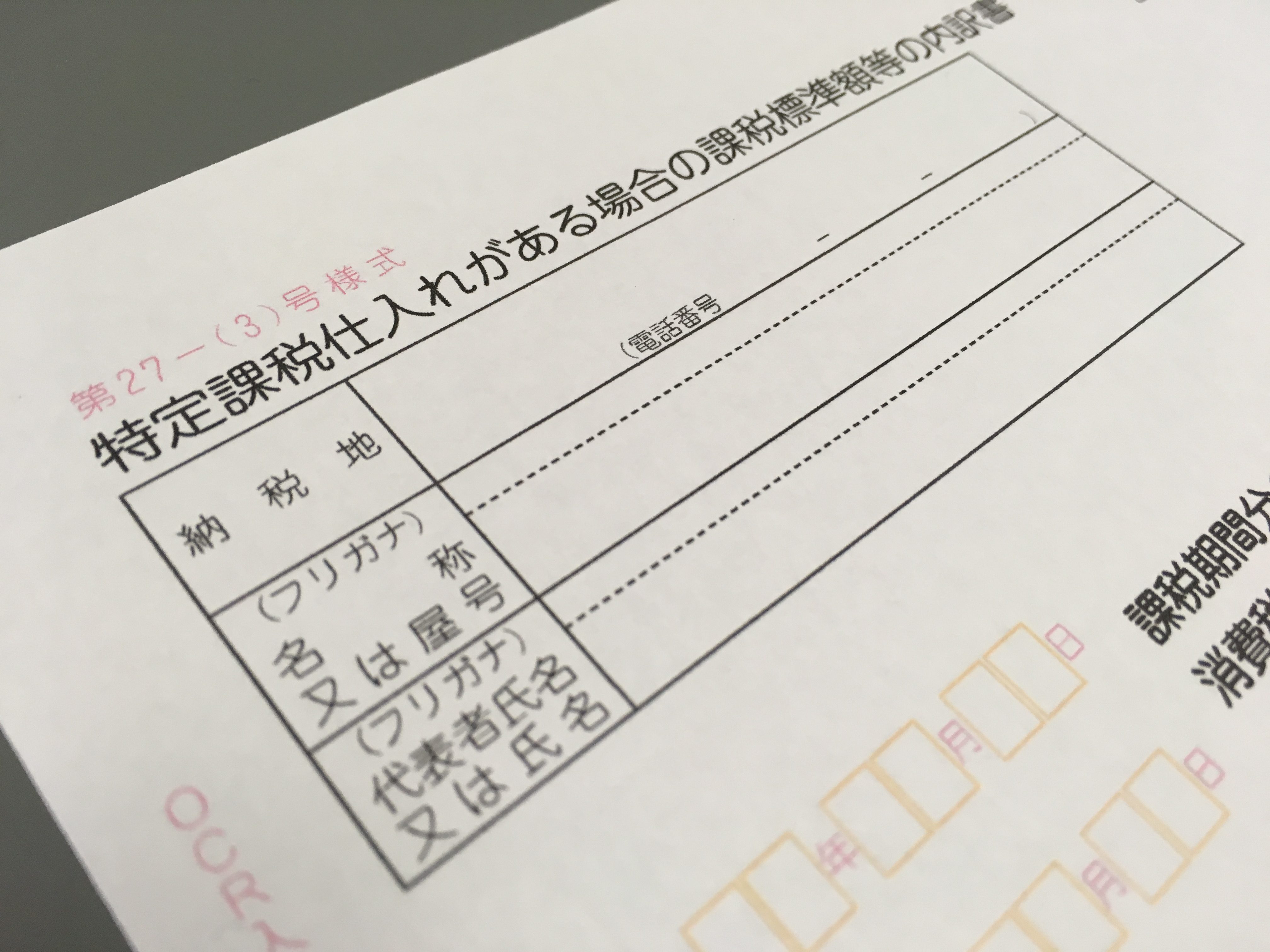

For the Japanese Consumption Tax purpose, the B2B services subscribed from offshore providers are called as “specified taxable purchase” .

Incidentally, B2B services subscribed from onshore providers are called as just “taxable purchase”.

Tax implication driven by your tax status

It does not mean that all domestic enterprise consumers should file the Consumption Tax return under Reverse Charge system.

Only when they meet all of the following conditions, the Reverse Charge system is applied and they need to file the tax returns on behalf of offshore B2B service provider together with their own tax returns.

- It is a taxable enterprise for the Consumption Tax purpose

- It does not apply the simplified tax reporting method

- Taxable sales ratio is smaller than 95%

- subscribed “specified taxable purchase” i.e., B2B service from offshore providers

This means you may be required to file the tax return applying Reverse Charge system in future once your taxable sales decrease to under 95% level and subscribe “specified taxable purchase” even now you do not.

So if you know current taxable sales ratio level and whether or not you have subscribed “specified taxable purchase”, you will be well prepared for tax filing under Reverse Charge system.

For that purpose, I strongly recommend you keeping your books and record as timely and accurate as possible.