Tax return filing due date for corporate taxpayers

Japanese consumption tax return filing due date is March 31st for individual enterprises. This may be little known among individuals who are exempted small enterprises for the consumption tax purpose.

Table of Contents

Linked to fiscal year ending date

Corporations are subject to the corporation tax on their income instead of income tax and need to file corporation tax return and pay tax due amount to the government.

Larger corporation would have to file tax return and make tax payment for the consumption tax as well.

Not like individual taxpayers’ case, filing due date for corporate taxpayers are not fixed on specific day but determined based on their fiscal year ending date, it is usually in 2-month from the ending date.

Everybody gets extension

Taxable income, tax base of corporation tax, is computed based on “net profit” reported in financial statements of a corporation.

However, it is quite usual that a corporation is not able to finalize its financial statements in 2-month after fiscal year ending date (especially large corporations who need more time for audit conducted by CPA) . Accordingly, the corporation tax law provides exception for extension of the filing due date.

Legally speaking, it is exception. But almost all of the corporate taxpayers get extension. So practically speaking, getting extension is usual.

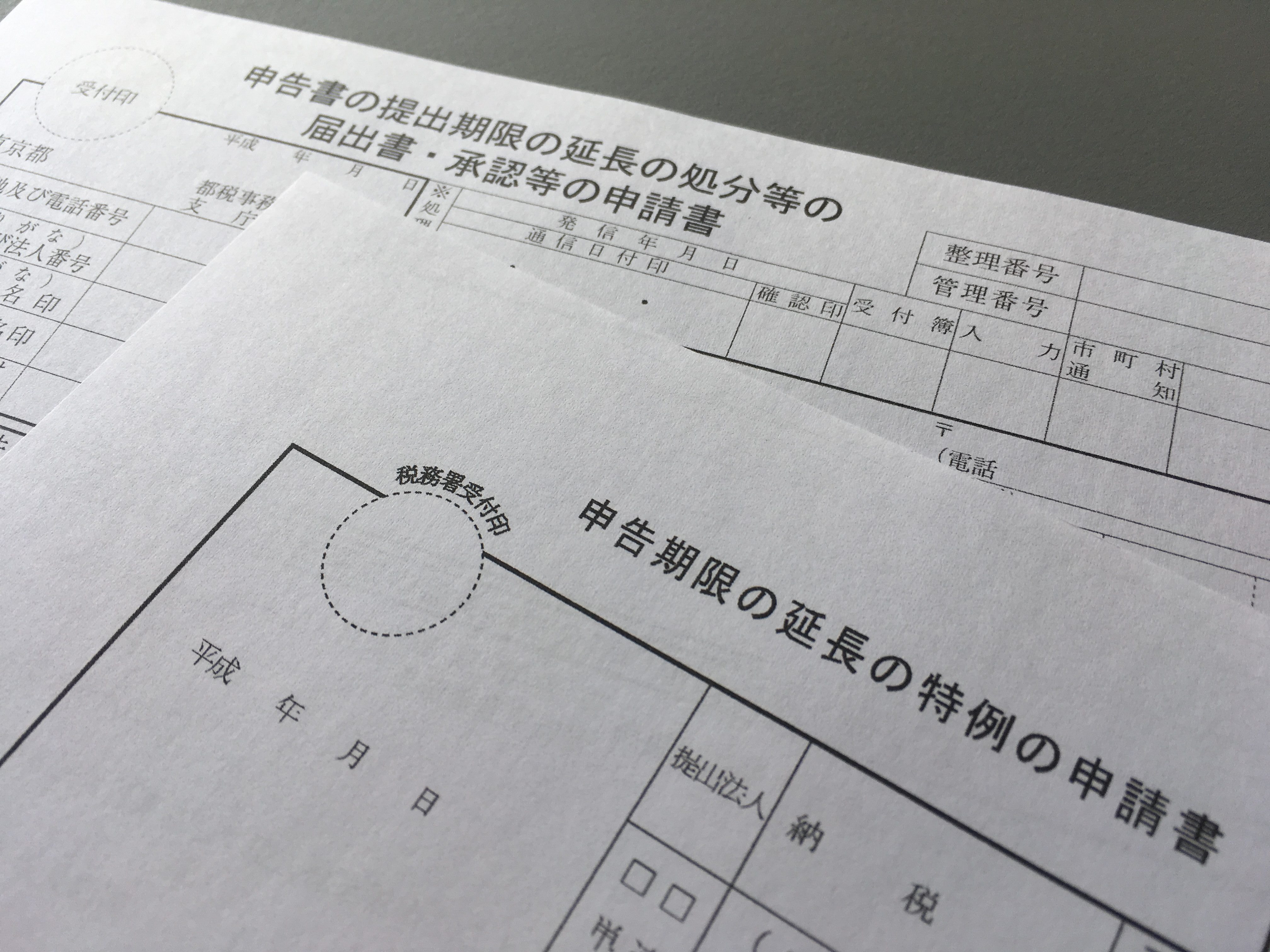

Advance approval is required

Extension is allowed only if you file application form to tax office and get approval from the relevant tax authorities.

The same extension rule exists for local taxes such as inhabitant tax and enterprise tax.

For local tax purposes, the application shall be filed to prefecture and municipal tax offices then need to get approval from relevant governor and mayor.

These application process should be completed in advance to starting date of the first fiscal year you want to get extension.

So if you realized “Oops!I cannot make it for the filing due date” amid year-end closing process, it is too late.

To avoid such disaster, you would better to file the application immediately after establishment of your corporation upon its notification to tax offices. You may retract the application anytime you want if you really do not need it.

Due date for tax payment is also extended, however….

Once extension of tax return filing due date is approved, tax payment due date is automatically extended.

However, tax payment made after the original payment due date (2-month after fiscal year ending date) is subject to “interest charge” (1.6% per annum for 2018).

So you should make provisional tax payment as soon as possible so that the interest charge is minimized even if you get the extension.

No extension for Consumption Tax!

There is no extension rule somehow.

Consequently, the filing and payment due date is within 2-month after fiscal year ending date.

This means you, even if extension is allowed for corporation tax return filing, have to file consumption tax return even if financial statements are not finalized.

I guess quite a few lawmakers and tax officials believe that taxpayers can compute consumption tax liability based on simple books and records before financial statements are finalized therefore extension is not necessary.

However, in practice, errors in books and records tend to be detected during year end closing process.

So some taxpayers end up with filing amended consumption tax returns soon after or together with filing corporation tax returns.

I would say the best way to avoid such trouble is keeping sales and purchase records in books timely and accurately.